Good morning, Big Brains. We’re officially five days away from the Citizen Townhall, and I couldn’t be more excited! Have you registered yet? I’ll be a sport and drop the link one more time.

- Margaret

Word count: ~ 1, 000

Reading time ~ 3 mins

Let’s get into today’s edition:

Nigerian SMEs are getting a new loan scheme

FG has had it with state governors

The Big Deal

Nigerian SMEs are getting a new loan scheme

We’d start this edition of the newsletter by singing Joy is Coming for Business owners, but Nigeria has ways of staining your white after you brag with it, so we’ll skip right to the news. The National Council on Micro, Small, and Medium Enterprises (MSMEs) has approved a new loan scheme for SMEs.

The council arrived at this decision during their first meeting of the year on Tuesday, February 18. The loan, which they have named Syndicated De-Risked Loans for Small Businesses, is part of FG’s efforts to provide Nigerian businesses with easily accessible loans that don’t require the toenails of their ancestors.

According to Vice President Kashim Shettima, who chaired the meeting, the Syndicated De-Risked Loans for Small Businesses will be a partnership between financial institutions and the government of Nigeria’s 36 states. They will give small businesses access to single-digit interest rates and will be built to outlive current administrations.

Apart from the approval of the loan scheme, the National Council on MSMEs also inaugurated a committee that would liaise with the Central Bank of Nigeria (CBN) to improve financing easier for small businesses.

Why is this a big deal?

Let’s start with the fact that SMEs are literally on life support and need this loan scheme like yesterday. This category of Nigerian businesses has been in massive gbese, which started gradually until there was nothing subtle about it again.

In 2017, the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) conducted an SME census in collaboration with the National Bureau of Statistics (NBS), which recorded the presence of 41 million small businesses in the country. By 2021, that number went down to 39 million (due to the impacts of COVID-19), and it just kept getting worse as the years rolled by.

The number of small-scale industrialists in the country also dropped from 246,200 in 2020 to 170,098 in 2022. Also, in 2023 alone, about 767 manufacturing companies in Nigeria shut down, while 335 wrestled with financial difficulties.

Small businesses are the backbone of growing economies globally, and we’re not just going on a limb to say this: the International Labour Organisation (ILO) has severally backed it up with data. Nigeria, for instance, owes the majority of its jobs and 46.31 per cent of its Gross Domestic Product (GDP) to SMEs.

But even though they play such an important role in the growth and stability of the economy, SMEs have a super hard time accessing finances because banks are too scared to loan them money. This partnership between financial institutions and state governments, as well as the intention with CBN, should, if well executed and managed, bring some relief to small businesses in the country.

The survival and well-being of SMEs translate to more job creation, wealth creation, and a faster arrival at Nigeria’s dream of being a one trillion-dollar economy. We’d love to see this happen sooner than later.

FG has had it with state governments

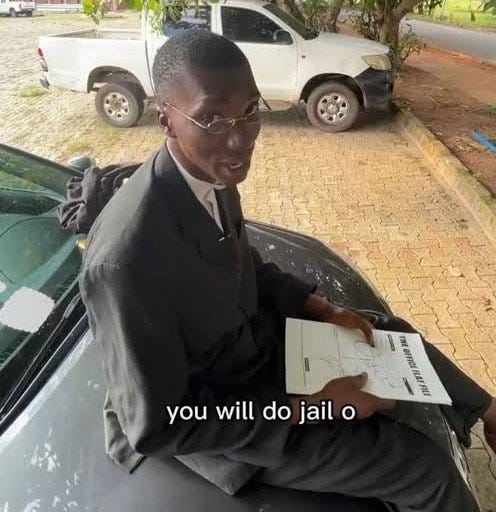

The Attorney General of the Federal (AGF) has just dropped a casual “you’ll do jail” for state governors and we are here for it.

On Wednesday, February 19, the AGF and Minister for Justice, Lateef Fagbemi, warned that it is not only illegal for state governors to dissolve duly elected local government administrations but also a treasonable offence. Fagbemi is not dropping this warning out of thin air; he is sick of state governors’ antics, and if you follow the story, you’ll see why, too.

Local Governments (LGs) are part of Nigeria’s three-tiered governments, and just like the Federal and State arms, LGs have things they’re supposed to take care of like the construction and maintenance of roads, public highways, streetlights, drains, and a bunch of other stuff. But the thing is that they have generally been unable to do these things because state governors render them useless by pocketing the money they get from FG.

This bullying was mostly easy for states to do because they shared a joint account with LG. So what would happen was that states took both the 26.72% belonging to them as well as the LG’s 20.60%.

They also didn’t allow LG elections to be held as regularly as they were supposed to. Even when they held, governors would dissolve the administrations and appoint questionable Caretaker Committees (AKA loyalists). The shit show went on for a long time until the AGF, Lateef Fagbemi, dragged state governors to court in 2024 for making a joke of the constitution and won– the Supreme Court, Nigeria’s highest court, affirmed the autonomy of LGs and declared Caretaker Committees illegal.

Now, imagine Lateef’s annoyance at finding out that some state governors are still messing with the system, even after they’ve been told not to. The AGF also said that state Attorney Generals and ministers of Justice also share in the blame because they sit idle and watch as governors break the law.

The AGF pointed out on Wednesday that neither state governors nor state houses of Assemblies have the power to dissolve LG administrations elected by the people and that they’d face brutal consequences if they continue doing this.

We actually want the AGF to stand on their ten toes because the genuine autonomy of LGs means better functionality, accountability and more. Sign us up for all of it, Chile!

This Week’s Big Question

“If you could meet one Nigerian politician (dead or alive), who would it be?”

Joshua’s response - “It’d be interesting to meet Yahaya Bello. Just for research purposes. ”

You can also share your response here, and if it’s as interesting Joshua’s, we’ll feature it in the next edition.

The Big Picks

CBN Orders Banks To Publish Dormant Account Holders’ Details Online: The Central Bank of Nigeria (CBN) has directed all banks and other financial institutions to disclose details of dormant accounts, including the names of account holders, the type of accounts, and the branches where the accounts are domiciled.

New Inflation Rate May Boost Investor Confidence But Won’t Ease Cost Of Living In Nigeria: Despite the statistical adjustment, Nigerians are advised not to expect immediate relief from high food and commodity prices.

Trump Calls Zelensky A 'Dictator' As He Hits Back At 'Disinformation' Criticism: Trump’s comments followed a statement from Zelensky, who said Trump is living in a "disinformation space" fuelled by Russia.